Xnnnnxx

Life, as we all know, can throw some real curveballs our way, can't it? One moment everything feels pretty steady, and the next, you might find yourself staring down an unexpected bill or a sudden need for funds. This feeling, this urgent need for a quick solution, is what we are exploring today, often hinted at by the mysterious term "xnnnnxx." It's not about what you might think at first glance, but rather about those moments when you need to act swiftly to keep your plans on track, you know?

There are times when waiting just isn't an option, and getting money fast becomes a top priority. Perhaps your car breaks down, or maybe a home repair pops up out of nowhere. These situations, in a way, are what "xnnnnxx" really represents for many folks: the search for rapid financial solutions to crush emergencies before they crush your plans. It's about finding that quick access to cash when you need it most, and frankly, it's a topic worth talking about openly.

So, we're going to peel back the layers on this idea, looking at how people approach these urgent needs and what sensible options might be out there. We'll chat about getting funds sent in as fast as one business day, or even having money deposited in four hours, as some services promise. It's all about understanding the landscape of immediate financial help and making choices that suit your budget and needs, isn't it?

- Neuro Gum Net Worth

- Does Lol Superman Exist

- Aishah Sofey Boobs Leak

- Pok%C3%A9mon Odyssey

- Aishah Sofey Leak Free

Table of Contents

- Understanding xnnnnxx: What It Really Means

- Why the Rush? Common Urgent Money Needs

- Finding Your Fast Funding Options

- The Application Process: What to Expect

- Making Smart Choices for Your Financial Well-Being

- Planning Ahead for Future Surprises

- Frequently Asked Questions About Urgent Funds

Understanding xnnnnxx: What It Really Means

When people talk about "xnnnnxx" in the context of urgent needs, they're often referring to that immediate requirement for financial support. It's not a specific product or service, but rather a way of describing the quick-paced world of getting money when time is of the essence. This term, in a way, captures the essence of seeking out swift solutions for life's financial hiccups. It's about finding ways to get funds sent in as fast as one business day, or sometimes even quicker, to handle those unexpected expenses that pop up.

The idea behind "xnnnnxx" really comes from the need for speed and accessibility in financial matters. Think about it: when an emergency hits, you don't have weeks to wait for a traditional loan process. You need a fast and easy approval, something that allows you to get your quick loan approval online. This desire for speed is what drives many to look for instant loans online, which come with a quick approval process and fast funding, as you might imagine.

So, when you hear "xnnnnxx," consider it a shorthand for the search for rapid financial relief. It's about exploring personal loans online that suit your budget and needs, and finding services like Wise loan’s instant funding that delivers money fast. It's a broad idea that covers everything from applying 24/7 to getting funds deposited in just a few hours, all aimed at helping you manage life’s expenses and, quite frankly, crush emergencies before they crush your plans.

- Aishah Sofey Content

- Agentredgirl

- Discovering The Multitalented Max Minghella An Artistic Journey

- Aishah Sofey Onlyfans Leaked

- Selena Quintanilla Outfits A Timeless Fashion Legacy

Why the Rush? Common Urgent Money Needs

People often find themselves in a situation where they need quick funds for emergency expenses, and this is where the concept of "xnnnnxx" truly comes into play. Life has a funny way of throwing unexpected costs our way, and sometimes, those costs just can't wait. Understanding these common scenarios can help you prepare or at least know what to look for when you're in a pinch, don't you think?

Unforeseen Household Repairs

Imagine your water heater suddenly decides to quit, or perhaps the roof starts leaking during a big storm. These kinds of household repairs are almost never planned for, and they often require immediate attention to prevent bigger problems. Getting quick funds for emergency expenses like these is a typical reason why people seek fast financial help, and it's a very real concern for many, isn't it?

Medical Emergencies and Health Expenses

Health issues can arise without warning, bringing with them potentially significant medical bills. Whether it's an unexpected trip to the emergency room or a sudden need for medication, these costs can add up fast. Having access to quick funds can be a real lifesaver in these moments, allowing you to focus on getting well rather than stressing about the money, which is pretty important, actually.

Vehicle Troubles and Transportation Needs

For many, a car is essential for getting to work, school, or even just running daily errands. When your vehicle breaks down, the repair costs can be substantial, and you might need to fix it right away to maintain your daily routine. This is another common scenario where people look for fast funding, because transportation is, you know, quite vital for most of us.

Unexpected Travel or Family Situations

Sometimes, an urgent family matter, like a sudden illness or a funeral, requires immediate travel. These trips can be expensive, especially when booked last minute. Having the ability to access funds quickly can make a big difference in these emotionally challenging times, allowing you to be there for your loved ones without added financial strain, which is pretty much what everyone wants.

Debt Consolidation for a Fresh Start

While not always an "emergency" in the same vein as a broken pipe, many people use unsecured personal loans with low interest with same day funding to consolidate debt. This can be a smart move to simplify payments, potentially lower interest rates, and get a better handle on your finances. It's a proactive way to manage life’s expenses and work towards a more stable financial future, so it's arguably a very sensible approach.

Finding Your Fast Funding Options

When you're facing one of those "xnnnnxx" moments and need money quickly, knowing where to look for help is, you know, half the battle. There are several ways people get access to cash when they need it most, and understanding these options can help you make a well-informed choice. It’s not just about speed, but also about finding terms that truly work for you.

Personal Loans for Quick Access

One of the most common ways people get quick funds is through personal loans. These are often unsecured, meaning you don't need to put up collateral like a car or house. Many providers offer instant loans online with a quick approval process and fast funding. Some, like Wise loan’s instant funding, aim to deliver money fast, which is really helpful when you're in a bind, isn't it?

You can use these loans for a whole range of things, from medical expenses to home repairs, or even to consolidate debt. The flexibility of personal loans makes them a popular choice for managing life’s expenses. Some are even voted best personal loan of 2024 by NerdWallet, which, you know, suggests a good reputation and reliable service, so that's something to consider.

Online Applications and Quick Approval

The beauty of today's financial services is how easy it has become to apply for loans online. You can often get your quick loan approval online, sometimes within minutes. This means you don't have to spend a lot of time filling out paperwork or waiting in line. It's about convenience and speed, allowing you to apply 24/7 and, in some cases, have funds deposited in as fast as four hours, which is pretty amazing.

This online accessibility is a huge benefit for those "xnnnnxx" situations, where every moment counts. It streamlines the entire process, making it much less stressful to get the money you need when you need it most. And that's, quite frankly, a big relief for many folks, isn't it?

Understanding Loan Terms and Conditions

While speed is important, it’s also vital to explore personal loans online that suit your budget and needs. This means looking beyond just the fast funding and checking the terms. All loan applications are subject to credit review and approval, and offered loan terms depend upon credit score, requested amount, requested loan term, credit usage, credit history, and other factors. So, it's not a one-size-fits-all situation, you know?

Credy provides instant online loan at low interest rate, which is a good example of a provider focusing on both speed and reasonable costs. Always take a moment to understand the flexible terms and easy repayment options. This step is crucial for making sure the quick fix doesn't turn into a long-term burden, which is something you definitely want to avoid, right?

The Application Process: What to Expect

When you're ready to tackle an "xnnnnxx" moment and apply for quick funds, the process is often simpler than you might imagine, especially with online options. It’s designed to be fast and easy, helping you get the money you need without too much fuss. Understanding what happens during the application can make you feel a bit more prepared, too, it's almost like knowing the steps before you take them.

Checking Your Rate Without Affecting Your Credit

A great feature many online lenders offer is the ability to check your rate for an online personal loan in minutes without affecting your credit score. This is a huge plus, as it allows you to shop around and compare offers without any commitment or worry about dinging your credit. It's a really smart way to start your search, so you can see what's available before you fully commit, isn't it?

This preliminary check gives you a good idea of what kind of interest rates and terms you might qualify for. It empowers you to make a more informed decision about which loan option is best for your particular situation. And that, frankly, is a pretty important first step when you're looking for quick financial help.

What Lenders Look At

Once you decide to move forward, lenders will typically look at a few key things to determine your eligibility and the loan terms. As mentioned, all loan applications are subject to credit review and approval. They'll consider your credit score, the amount you're asking for, how long you want to pay it back, your past credit usage, and your overall credit history. These factors help them assess the risk involved, you know?

It’s important to remember that every lender is a bit different, and their criteria can vary. But generally, having a decent credit history can open up better loan terms, like lower interest rates. This is why it’s always a good idea to keep an eye on your credit health, even when you're not actively looking for a loan, because it can really help when those "xnnnnxx" moments pop up.

Making Smart Choices for Your Financial Well-Being

Addressing an "xnnnnxx" situation isn't just about getting money fast; it's also about making choices that support your overall financial well-being. It’s easy to focus solely on the speed of funding, but taking a moment to consider the bigger picture can save you from future headaches. This part is, you know, where the real wisdom comes in, arguably.

Flexible Terms and Easy Repayment

When you explore personal loans online, look for options that offer quick approvals, flexible terms, and easy repayment. A loan that fits your budget for repayment is far more sustainable than one that strains your finances every month. Some lenders, like Credy, focus on providing instant online loans at low interest rates, which can make repayment much more manageable. It's about finding that balance, isn't it?

Having a repayment plan that you can comfortably stick to is, quite frankly, as important as getting the money quickly. You want to make sure the solution to your immediate need doesn't create new problems down the road. So, always read the fine print and understand your payment schedule before you commit, because that's just smart money sense.

Low Interest Rates: A Key Consideration

While the urgency of "xnnnnxx" might make you overlook details, interest rates are a big deal. Using unsecured personal loans with low interest with same day funding can save you a significant amount of money over the life of the loan. A lower interest rate means less money paid back overall, which leaves more money in your pocket for other things. It's a pretty straightforward concept, but sometimes overlooked when you're in a rush.

Comparing rates from different providers is always a good idea. Even a small difference in the interest rate can add up, especially on larger loan amounts or longer repayment terms. So, take the time to check your rate and compare offers; it’s a small effort that can yield big savings, and that's something everyone appreciates, right?

Planning Ahead for Future Surprises

Even after you've handled an "xnnnnxx" situation, it's a good idea to think about how you can better prepare for future unexpected needs. Life will always throw curveballs, but having a financial cushion can make those moments less stressful. This proactive approach is, you know, a very powerful tool for your peace of mind.

Building an emergency fund is arguably the best way to prepare. Setting aside a little bit of money regularly, even a small amount, can grow into a significant safety net over time. This fund can act as your first line of defense against those sudden expenses, reducing your reliance on quick loans and their associated costs. It’s about creating a buffer, really.

Also, keeping an eye on your credit score and managing your existing debts responsibly can put you in a better position if you do need to seek quick funds again. A good credit history often means access to better loan terms and lower interest rates. It's like having a good reputation; it just makes things easier, doesn't it? For more general financial planning insights, you might find helpful information on sites like the Consumer Financial Protection Bureau, which is a pretty reliable source.

Remember, the goal is to be ready for whatever comes your way. Whether it's a small repair or a larger emergency, having a plan and understanding your options can make all the difference. It's about empowering yourself financially, so you can face life's surprises with confidence. Learn more about financial readiness on our site, and you can also find more details on managing unexpected costs by visiting this page here.

Frequently Asked Questions About Urgent Funds

People often have similar questions when they're looking for quick financial help, especially when dealing with what we're calling "xnnnnxx" moments. Here are a few common inquiries and some straightforward answers, because getting clarity is pretty helpful, isn't it?

How fast can I actually get money if I apply online?

Many online lenders boast a quick approval process and fast funding. Some services promise funds deposited in as fast as four hours, while others might take one business day. It really depends on the lender and your bank, but generally, it's designed to be very quick. So, you know, it's often much faster than traditional methods.

Will checking my loan rate affect my credit score?

Most reputable online lenders allow you to check your rate for an online personal loan in minutes without affecting your credit score. This is often called a "soft inquiry" and doesn't show up on your credit report in a way that impacts your score. It’s a great way to compare options without any risk, which is pretty convenient, actually.

What factors determine the loan amount and terms I can get?

Offered loan terms depend upon several things, including your credit score, the amount you're asking for, how long you want to pay it back, your credit usage, your credit history, and other factors. Lenders look at these details to assess your ability to repay the loan. So, a good credit history can definitely help you get better terms, arguably.

- Leanne Morgan Journey Concert

- Lamar Jackson Injury History

- Tess Dinerstein White Horse

- Aishah Sofey Content

- Aishah Sofey Leak Free

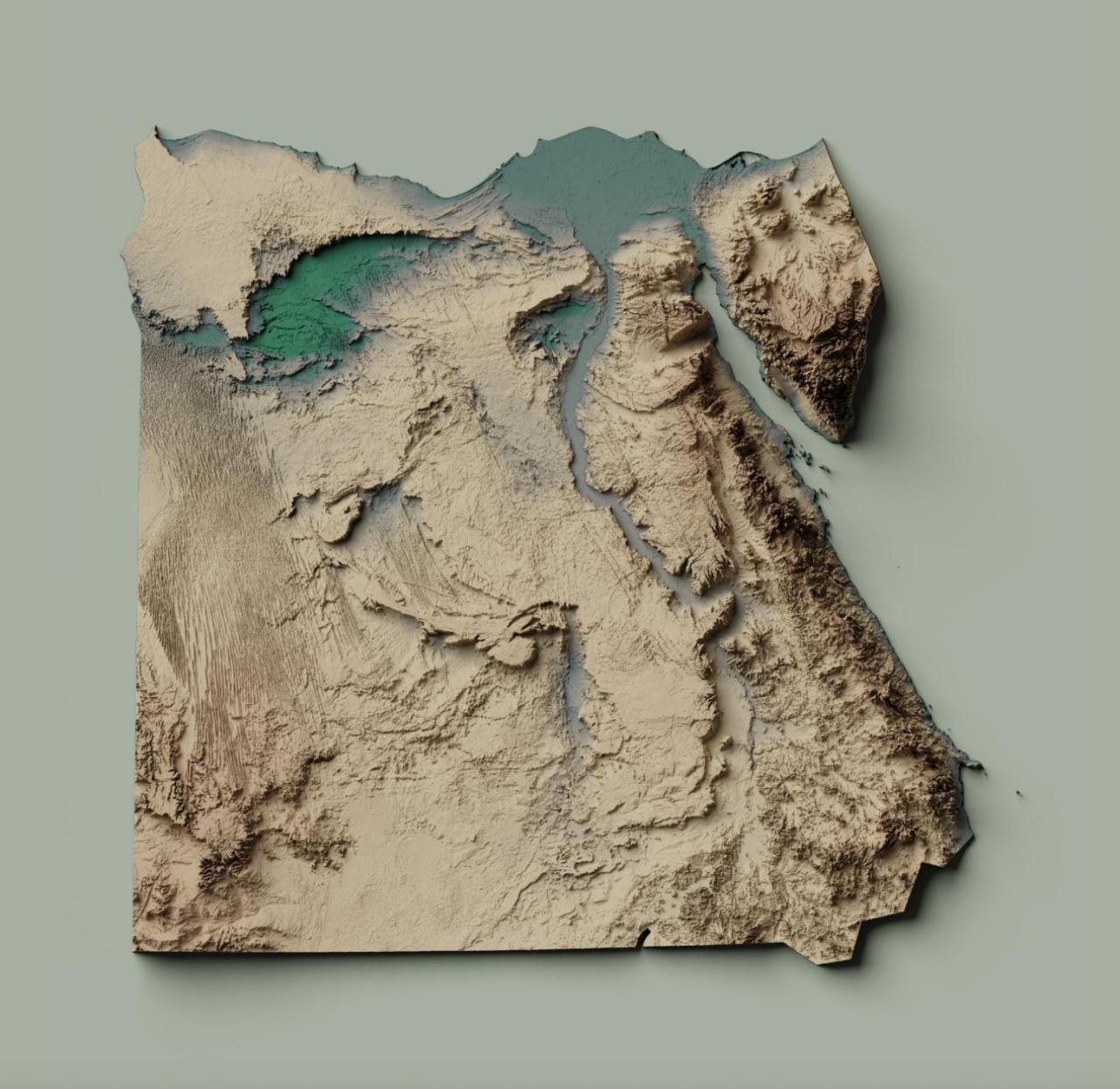

Exaggerated relief map of Egypt. - Maps on the Web