Iran Oil: Unpacking Its Global Role And Energy Impact

Iran, a nation known for its long, long history and distinct culture, holds a truly significant spot on the world's energy map. This is, as a matter of fact, very much due to its abundant oil resources, which have shaped its past and continue to influence its present. For anyone curious about global energy flows or the intricate dance of international relations, understanding Iran's oil story is, you know, pretty essential.

This country, officially the Islamic Republic of Iran, or IRI, and sometimes called Persia, is, well, a land in West Asia. It shares borders with Iraq to the west, and then Turkey, Azerbaijan, and Armenia to the northwest. Also, it sits between the Caspian Sea up north and the Persian Gulf and the Gulf of Oman down south. It’s a place that is, in a way, quite mountainous, rather dry, and has many different ethnic groups.

The heart of the ancient Persian empire, Iran has, you see, consistently played a really important part in its region. Its oil industry, in particular, often finds itself at the center of news reports and global discussions. We’re going to look closer at what makes Iran’s oil such a big deal, its production, and the challenges it faces.

- Selena Quintanilla Outfits A Timeless Fashion Legacy

- Froot Vtuber Cheating

- Haircuts For Straight Hair Men

- How Much Is A House In Iran

- Where Is Phoebe Cates Now A Look Into Her Life And Career

Table of Contents

- Iran: A Nation of Significance

- Iran's Vast Oil Wealth

- The Flow of Oil: Production and Exports

- Sanctions and Resilience: A Constant Battle

- Geopolitical Tensions and Energy Prices

- Looking Ahead: The Future of Iran Oil

- Frequently Asked Questions About Iran Oil

Iran: A Nation of Significance

Iran, a nation officially known as the Islamic Republic of Iran, or IRI, is, you know, a country with a very long and storied past. It’s also often referred to as Persia, a name that brings to mind its ancient history and cultural depth. This land is located in West Asia, and its position gives it a truly important role in the area. For instance, it borders Iraq to the west, and then Turkey, Azerbaijan, and Armenia to its northwest. It’s a place that is, apparently, quite diverse, with many different groups of people living there.

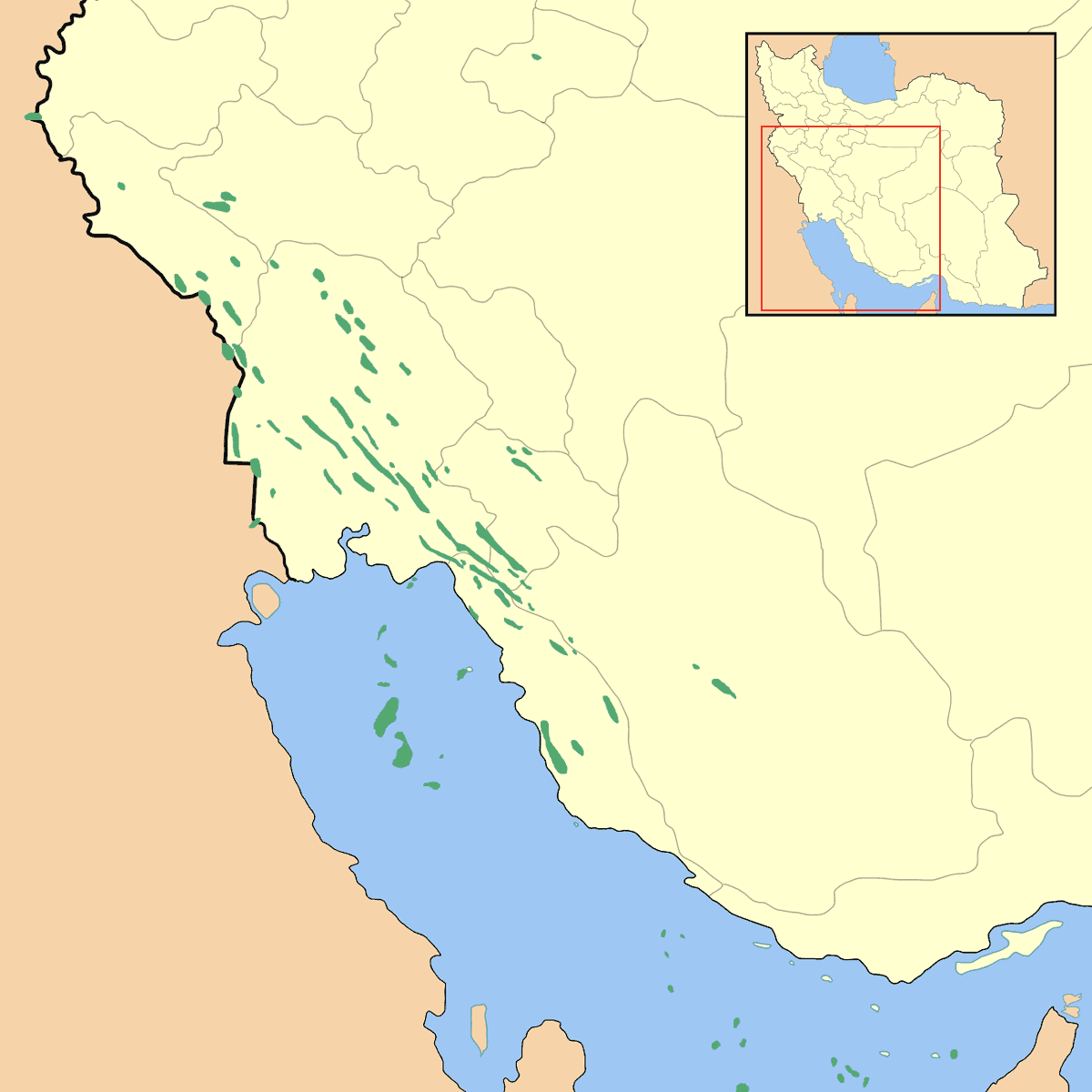

The physical makeup of Iran is, as a matter of fact, something to consider. It’s a country that is, in a way, quite mountainous and also rather dry. This terrain shapes how people live and how resources are found and used. You can find detailed physical maps showing its major cities, its land features, its national parks, and the rivers that flow through it. These maps also show the countries that surround Iran and where the international borders lie. This geographic setting is, therefore, a fundamental part of understanding the nation.

Historically, Iran has, to be honest, always been a key player in its region. It was the heart of the Persian Empire of antiquity, a power that, you know, left a big mark on the world. This long history means Iran has, in some respects, a deep-seated influence in West Asia. Its political structure is a constitutional Islamic republic, which operates with a theocratic system of government. This means that religious authority holds, well, the ultimate political power. This system, too, shapes many aspects of life in the country, including its approach to its natural resources.

- Fiona Gallagher Shameless

- Exploring Malachi Bartons Relationships The Young Stars Personal Connections

- The Enigmatic Journey Of Theo James A Star In The Making

- Morten Harket The Voice Of Aha And His Enduring Legacy

- Morgan Wallen Setlist Miami

Keeping up with news from Iran is, naturally, something many people do to stay informed about regional happenings. News sources like AP News provide regular updates, covering events as they happen. You can find articles and videos that give you a picture of the latest developments. This includes, for example, politics news headlines and reports on various incidents. It’s a country that, you know, often makes headlines, and its activities are watched by many around the globe.

The country’s unique aspects also make it, arguably, a distinct place to visit, for those who travel. Its blend of ancient history, diverse cultures, and its particular system of government creates, well, a truly singular experience. So, whether you’re looking at its history, its geography, or its current affairs, Iran is a nation that holds, you know, a very important place on the world stage, especially when it comes to energy.

Iran's Vast Oil Wealth

When we talk about Iran oil, we are, basically, talking about a truly significant amount of the world's energy supply. Iran possesses, as a matter of fact, some of the largest proven oil reserves anywhere. According to its government, these reserves were, as of 2013, the fourth largest in the entire world. This is, you know, a truly immense quantity of oil that sits beneath its land. It’s a figure that puts Iran in a very select group of nations that hold such vast energy resources.

There's a bit of a nuance to this ranking, too. While Iran claims the fourth spot, it could, arguably, even rank third globally if you consider Canadian reserves of unconventional oil separately. This distinction is, in a way, important for understanding the full picture of global oil distribution. Regardless of whether it’s third or fourth, the sheer volume of oil Iran has is, well, something that cannot be overlooked. It gives the country, you see, a substantial position in the global energy market and impacts its international relations.

These proven oil reserves are, naturally, a core part of Iran’s economic strength and its geopolitical influence. The presence of such large quantities of oil means that Iran is, therefore, a nation with the potential to supply a significant portion of the world's energy needs for a very long time. This resource is, obviously, a key factor in many discussions about the country, from its economy to its foreign policy. It’s a source of both opportunity and, sometimes, tension on the global stage.

The scale of these reserves also means that the infrastructure to extract and process this oil is, you know, quite extensive. Iran has, in some respects, a long history of oil production, and its facilities are spread across the country. Understanding where these reserves are located and how they are accessed is, frankly, central to grasping Iran’s role in the energy world. It’s not just about the oil itself, but the entire system that brings it from the ground to the market.

The Flow of Oil: Production and Exports

Iran is, actually, a truly important producer within the Organization of the Petroleum Exporting Countries, or OPEC. It holds the position of the third largest producer within this group, which is, you know, a very significant role. This means Iran contributes a substantial amount of oil to the global supply. Its daily output is, as a matter of fact, quite considerable, showing its capacity to pump large volumes of crude oil.

To give you a clearer idea, Iran extracts about 3.3 million barrels of oil each day. This daily figure, you see, represents around 3% of the total global oil output. So, while it’s not the absolute largest producer, its contribution is, nevertheless, a notable piece of the worldwide energy puzzle. This steady flow of oil is, in a way, vital for many economies that rely on consistent energy supplies. It shows Iran’s ongoing capacity, even with various challenges, to maintain a significant level of production.

The ability of Iran to keep its oil exports flowing, even when faced with sanctions, truly shows, you know, the limits of Western enforcement, particularly when it comes to activities at sea. Iran has, in some respects, found ways to sustain its exports, defying efforts to curb them. This demonstrates a certain level of resilience and, perhaps, a creative approach to managing its trade. The maritime domain, in particular, seems to be an area where enforcement can be, well, quite difficult to achieve completely.

Looking at the numbers, crude oil and condensate exports from Iran have, frankly, seen a very big increase in recent years. Between 2020 and 2023, these exports more than tripled. They reached a daily volume of over 1.59 million barrels. This surge in exports is, obviously, a clear indication of Iran’s efforts to maintain its presence in the global oil market and generate revenue, despite external pressures. It’s a trend that, you know, many observers watch very closely.

Beyond crude oil, Iranian petroleum product exports have, also, increased. This suggests a broader effort to diversify its energy exports and maximize the value of its resources. The Iranoilgas network, for instance, is a leading independent Iranian oil, gas, and petrochemical information network. It provides daily news, details on companies and projects, tenders, and information on oil and gas fields. It’s, basically, a hub for exclusive insights into Iran’s energy sector, showing how active and complex this industry truly is.

Sanctions and Resilience: A Constant Battle

Sanctions have, for a long time, been a favored tool used by the U.S. to try and reduce Iran's oil exports. This approach is, you know, typically put in place to pressure Iran on various issues. The idea is to limit Iran’s ability to sell its oil, thereby cutting off a major source of its income. This strategy has been applied, in some respects, consistently over the years, with varying degrees of impact on Iran’s economy. It’s a clear demonstration of how economic measures are used in international relations.

However, Tehran’s response to these sanctions has, frankly, been just as predictable. Their approach is, basically, to deny the effectiveness of the sanctions, deflect criticism, and then, crucially, keep their tankers moving. This means finding ways to circumvent the restrictions and continue selling oil on the global market. This strategy shows, you know, a determined effort to resist external pressure and maintain economic activity, even under difficult circumstances. It’s a constant back-and-forth between the two sides.

The ability of Iran to sustain oil exports in defiance of sanctions truly highlights, as I was saying, the limits of Western enforcement. This is particularly true in the maritime domain, where tracking and stopping every shipment can be, well, quite a challenge. The vastness of the oceans and the methods used to disguise shipments make it, in a way, very difficult to fully cut off Iran's oil trade. This resilience is, therefore, a key characteristic of Iran’s oil industry under sanctions.

Anxiety often mounts regarding Iran's oil supply, especially when there are extreme tensions. There’s always the concern that its supply could be disrupted, which could, you know, cause a sudden increase in international oil prices. This connection between geopolitical events and energy prices is, obviously, a significant aspect of the global market. Facts on Iran’s oil industry often focus on this potential for disruption and its broader impact.

The increase in crude oil and condensate exports between 2020 and 2023, which more than tripled to over 1.59 million barrels per day, is, you know, a clear sign of this resilience. Despite the sanctions, Iran has found ways to significantly boost its oil sales. This shows, in some respects, a continuous effort to adapt and overcome restrictions. It's a very real example of how nations respond when their primary economic lifelines are targeted.

Geopolitical Tensions and Energy Prices

Military strikes in Iran are, basically, something that always raises questions about the impact on supplies of oil and gas. This is, as a matter of fact, a very immediate concern for global energy markets. The worry is that any widening conflict could, you know, result in higher energy prices for consumers around the world. It’s a direct link between political events and the cost of fuel that many people experience daily.

For example, President Donald Trump once said that the U.S. attacked three sites in Iran that were related to the country's nuclear program. Such actions, regardless of their specific targets, tend to create unease in the oil market. The mere possibility of disruption can cause, well, a ripple effect that influences prices. This shows how sensitive the market is to any perceived threat to supply, even if the facilities are not directly oil-related.

A look at Iran’s oil and gas facilities, including those that have been targeted, reveals the scale of the infrastructure involved. For instance, the Israeli Air Force (IAF) struck an Iranian portion of the world’s largest natural gas reserve. This particular reserve is, you know, located about 100 miles from its Qatari section. Such strikes, even on gas facilities, contribute to the overall tension and can, therefore, impact the broader energy outlook. It’s a very real concern for stability in the region and for global energy security.

The anxiety that mounts over Iran’s oil supply, particularly when there is extreme tension, is, frankly, a constant feature of the market. The fear is that any disruption could, as I was saying, cause a surge in international oil prices. This is why news about Iran’s politics and military activities is, you know, watched so closely by energy analysts and traders worldwide. It’s a very direct link between geopolitical events and the cost of oil.

The increase in crude oil and condensate exports from Iran between 2020 and 2023, despite sanctions, also shows a complex picture. While tensions exist, Iran has, in some respects, managed to increase its exports. This indicates a persistent effort to maintain its oil revenue, even in a challenging environment. However, the potential for military action to disrupt this flow remains, arguably, a significant factor in how the market views Iran oil.

Looking Ahead: The Future of Iran Oil

The future of Iran oil is, basically, a topic that continues to draw a lot of attention. Given its truly vast proven oil reserves and its role as a major producer, Iran will, you know, always be a significant player in the global energy scene. The ongoing challenges it faces, particularly from international sanctions, mean its path forward is, in a way, quite complex. Yet, its ability to keep exports flowing shows a certain level of adaptability.

The dynamic between sanctions and Iran’s efforts to bypass them is, frankly, a continuous one. This back-and-forth will, therefore, likely shape how much oil Iran can bring to market in the coming years. The global demand for energy, too, will play a part. As the world’s energy needs evolve, Iran’s oil will, in some respects, remain a key consideration for supply and pricing. It’s a very real factor in the overall energy equation.

The Iranoilgas network, for instance, provides a constant stream of information on Iran’s oil, gas, and petrochemical sectors. This suggests that the industry itself is, you know, very active and always developing. New projects, tenders, and field discoveries are, as a matter of fact, regularly reported. This indicates that despite the pressures, Iran is still investing in and working to expand its energy capabilities. This ongoing activity is, obviously, something to watch.

Regional tensions and their potential impact on oil prices will, sadly, probably remain a concern. Any military actions or escalations in the area have, you know, the potential to cause disruptions that affect global energy markets. This means that the geopolitical situation surrounding Iran is, in a way, inextricably linked to the future of its oil industry and its influence on world prices. It’s a very delicate balance that everyone watches.

Ultimately, Iran oil will, in some respects, continue to be a very important element in discussions about global energy security and supply. Its resources are too substantial to ignore, and its position in West Asia gives it a truly unique influence. How it navigates the complexities of sanctions, regional politics, and global demand will, therefore, determine its precise role in the energy landscape moving forward. It’s a story that is, you know, always unfolding.

Frequently Asked Questions About Iran Oil

How much oil does Iran produce daily?

Iran, as the third largest producer within OPEC, extracts about 3.3 million barrels of oil each day. This amount represents, you know, around 3% of the total global oil output. So, it’s a very significant contribution to the world’s daily energy supply.

What is the impact of sanctions on Iran's oil exports?

Sanctions have been a tool to try and curb Iran’s oil exports. However, Iran has, in some respects, shown resilience, finding ways to sustain and even increase its exports. For example, crude oil and condensate exports more than tripled between 2020 and 2023, reaching over 1.59 million barrels per day. This shows, you know, the limits of enforcement, especially in the maritime domain.

Where does Iran rank in global oil reserves?

According to its government, Iran’s proven oil reserves were, as of 2013, the fourth largest in the world. It could, arguably, even rank third if Canadian reserves of unconventional oil are considered separately. So, Iran holds, basically, a truly vast amount of the world's known oil.

Conclusion

Iran's oil industry is, you know, a truly central part of its identity and its standing in the world. From its very large oil reserves, ranking among the top globally, to its daily production as a key OPEC member, Iran’s energy resources are, as a matter of fact, a major force. We’ve seen how geopolitical tensions and international sanctions create constant challenges, yet Iran has, in some respects, shown a remarkable ability to keep its oil flowing.

The interplay of its vast resources, its strategic location in West Asia, and the ongoing international dynamics means that Iran oil will, therefore, always be a topic of global interest. It’s a story of resilience, economic pressure, and the complex relationship between energy and world events. To stay informed about these developments, you can Learn more about Iran's economic policies on our site, and for deeper insights into global energy markets, you can also explore our dedicated energy analysis page.

- Asianbunnyx Leaks

- Tess Dinerstein White Horse

- Iran Live Cameras

- Lol Superman Explained

- Sophie Rain Spider Man Video

Iran Oil Map - MapSof.net

/wion/media/post_attachments/files/2020/12/16/174241-iran-oil-production.jpg)

Iran oil News - Latest Iran oil News, Breaking Iran oil News, Iran oil

108042684-1727950207319-gettyimages-2021282094-ir_oil_terminal_iran